Business & Corporate Tax Services:

- Preparation of corporate tax returns

- Financial statements

- GST, PST, and WCB returns

- Tax minimization strategies

- CRA audit consulting

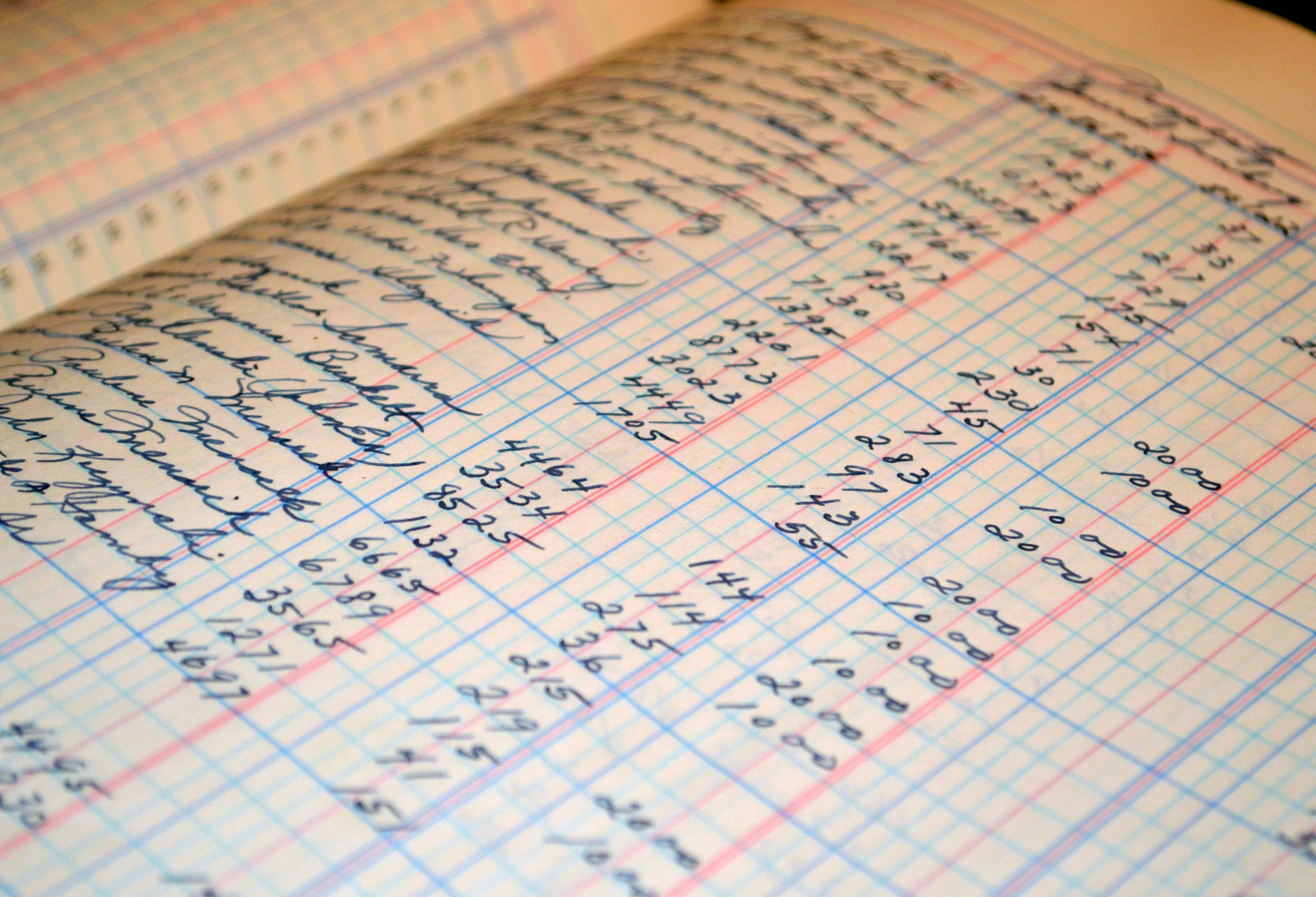

- Bookkeeping

- Payroll

Personal Tax Services:

- Personal Income taxes

- Sole proprietorships

- Rental Income

- Farming Income

- Capital Gain

- Income splitting

- Foreign reporting

- Retirement and succession planning

- Assistance with late tax and election filings to help minimize late filing and penalties

Trust & Estate Tax Planning Services

- Estate planning strategies

- Inheritance tax management

- Compliance with the filing of trust and estate returns

Advisory

- Business start-up or expansion

- Accounting software selection and implementation

- Financial and retirement planning

- Cash Flow Forecasting